05.05.2025

05.05.2025

7min

7min

05.05.2025

05.05.2025

7min

7min

For UK businesses, integrating a payment gateway is more than just a technical checkbox. It's a strategic decision that can significantly impact both customer experience and your bottom line. Understanding how these gateways operate within the larger financial ecosystem is key to making informed choices. This section explores the various types of payment gateways and what they mean for your UK business.

Different payment gateways offer varying degrees of control and customization. Selecting the right one hinges on your specific business needs and technical capabilities. Let's break down the most common types:

Hosted Payment Gateways: These redirect customers to a third-party page to complete their purchase. This simplifies integration and reduces PCI DSS compliance burdens. It's an ideal solution for smaller businesses or those new to online sales. However, this redirection can sometimes disrupt branding and the overall user experience.

API-Integrated Gateways: If you're looking for maximum control over the customer journey, API integrations allow payments to be processed directly on your website. This creates a seamless, branded checkout experience, which can significantly boost conversions. However, this approach requires more technical expertise and increases your PCI DSS responsibilities.

Self-Hosted Gateways: This option gives you complete control over the entire payment process, from collecting payment information to processing transactions. While it offers the highest level of customization, it also demands significant development resources and stringent security measures.

Understanding these gateway types is crucial for choosing a solution that aligns with your resources and meets customer expectations. The right gateway lays the foundation for a positive customer experience and efficient payment processing. This leads us to the next important aspect – understanding the growth and potential of the UK payment gateway market.

The UK's enthusiastic adoption of digital commerce is fueling substantial growth in the payment gateway market. This thriving sector presents significant opportunities for businesses ready to capitalize on evolving consumer behavior. The UK payment gateway market reached USD 1,797.1 million in 2023. It's projected to reach USD 7,294.2 million by 2030, demonstrating a CAGR of 22.2%. This impressive growth highlights the increasing importance of seamless and secure online payment options for UK businesses. Find more detailed statistics here. This dynamic landscape makes careful gateway selection even more critical.

The features of your chosen payment gateway directly impact customer trust. Offering a variety of popular payment methods, such as debit and credit cards, digital wallets like Apple Pay and Google Pay, and even Buy Now Pay Later options, can greatly improve conversion rates. Clearly displaying security badges and certifications further strengthens customer confidence. Moreover, integrating a payment gateway allows you to expand your reach beyond the UK. By supporting multiple currencies and international payment methods, you can tap into global markets and unlock new revenue streams. This strategic approach to payment gateway integration positions your business for sustained growth and success.

Integrating a payment gateway is a big step for any UK business. But before diving into the technical details, it's essential to lay a strong foundation. This groundwork will ensure a smoother integration and contribute to your long-term success. It involves understanding compliance, assessing your needs, and planning your technical infrastructure.

For UK businesses, adhering to payment regulations is crucial. The Payment Card Industry Data Security Standard (PCI DSS) outlines key security requirements for handling sensitive cardholder data. This isn't just a checklist item; robust PCI DSS compliance builds trust with your customers and protects your business from expensive data breaches.

Additionally, Strong Customer Authentication (SCA), a core element of PSD2, adds another layer of security for online transactions. Successfully implementing SCA, while keeping checkout friction low, is a challenge for many UK merchants. Understanding different marketing strategies is key to a solid foundation, much like understanding Demystifying Microinfluencers.

Choosing the right payment gateway starts with understanding your specific business requirements. This goes beyond just transaction volumes. Analyze your customer behavior. Do your customers prefer paying on their mobile devices? Which card types are most commonly used? Do they prefer digital wallets like Apple Pay or Google Pay?

Answering these questions helps you select a gateway that supports your customers' preferred payment methods, enhancing their overall experience. You might also want to consider e-commerce website development to optimize your online store.

The technical infrastructure behind your payment gateway is as critical as the gateway itself. A reliable and secure hosting environment is essential for seamless processing. Consider factors like server capacity, uptime guarantees, and security protocols.

This ensures your payment system can handle peak traffic and protects sensitive customer data. A well-designed website with a user-friendly checkout contributes to a positive customer experience and boosts conversions.

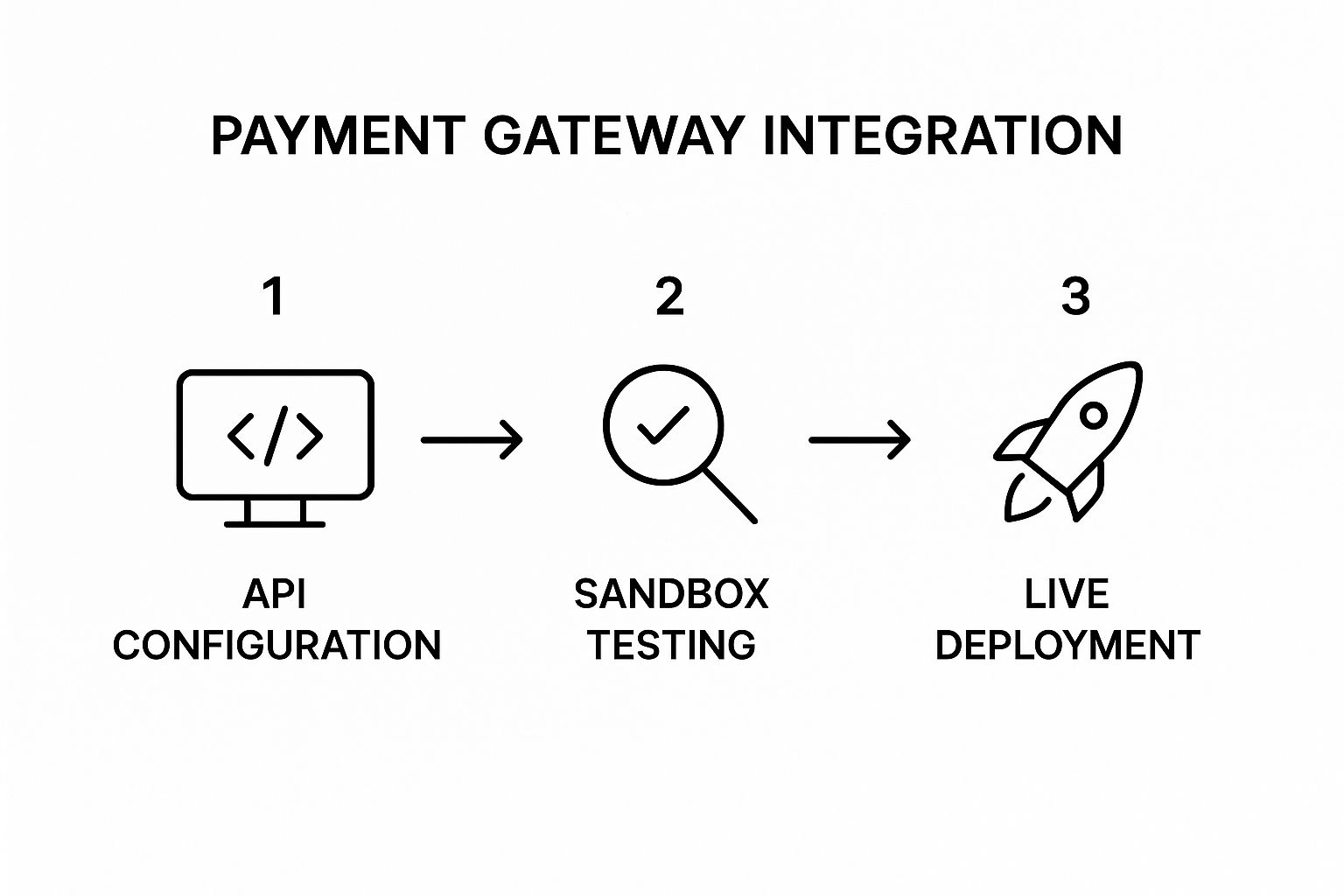

This infographic illustrates the payment gateway integration process. It highlights the journey from the initial API setup and rigorous testing in a sandbox environment to the final live deployment. This phased approach ensures a secure and reliable payment system for your business. Testing everything thoroughly beforehand minimizes disruptions for your customers.

Now, let's explore the practical steps involved in integrating a payment gateway, especially within the UK context. This guide will walk you through the key stages, incorporating best practices learned from successful UK businesses.

Selecting the appropriate payment gateway is crucial for your business. Consider key factors such as transaction fees, supported payment methods, and robust security features. Think about the specific needs of your UK customers.

For instance, offering popular payment options like Apple Pay and Google Pay can significantly enhance the checkout experience. If you offer subscription services, ensure the gateway supports recurring billing.

After selecting a provider, you’ll receive your API credentials. These credentials are essentially a digital key, enabling your website to communicate securely with the payment gateway. Protecting these credentials is paramount.

Store them securely and adhere to best practices to prevent unauthorized access. This protects your business and your customers’ sensitive financial data.

Your payment forms significantly impact your conversion rates. Keep forms concise, clear, and user-friendly. Clearly display accepted card types and security badges to build customer trust.

Optimizing your forms for mobile devices is also essential, as more and more UK consumers prefer to shop on their phones.

Before launching, sandbox testing is critical. This simulated environment lets you test the entire payment process without using real transactions. It’s the perfect opportunity to identify and fix any bugs or issues.

Test various scenarios, including successful payments, declined transactions, and refunds, to ensure a smooth and reliable experience for your customers.

To understand payment trends, let's look at the UK digital payments market. By 2025, the total transacted value is projected to reach £447.9 billion. This underscores the growing importance of seamless payment gateway integration. Learn more about UK payment trends.

After thorough testing, you can go live with your integrated payment gateway. However, the process doesn't stop there. Continuous monitoring is key.

Track important metrics such as transaction success rates, processing times, and conversion rates. This enables you to identify any issues and optimize your payment system for optimal performance. After integration, consider additional features like offering digital gift cards through platforms like Cardivo.

To help you choose the right integration method, take a look at the comparison table below:

Payment Gateway Integration Methods Comparison This table compares different approaches to integrating payment gateways based on complexity, security, and customer experience.

| Integration Method | Implementation Complexity | Development Time | Customer Experience | Security Control | Best For |

|---|---|---|---|---|---|

| Direct Integration | High | Long | Highly Customizable | Full Control | Large enterprises with dedicated development teams |

| Hosted Payment Page | Low | Short | Simple and Secure | Limited Control | Small to medium businesses |

| Third-Party Plugins | Medium | Moderate | Varies depending on the plugin | Shared Control | Businesses using popular e-commerce platforms |

The table above highlights the trade-offs between different integration methods. Direct integration offers the most control but requires significant development effort. Hosted payment pages are easier to implement but offer less customization. Third-party plugins offer a middle ground. Choose the method that best suits your business’s resources and needs.

Security is paramount for online payments. For UK businesses, it's not just about ticking technical boxes; it's the bedrock of customer trust. And that trust directly impacts your bottom line through higher conversion rates and a stronger brand. This section explores the practical security measures successful UK businesses are using to protect their customers and their revenue.

Protecting sensitive customer data is crucial. Tokenization and encryption are key players in this arena. Tokenization swaps sensitive card details for unique, non-sensitive tokens, minimizing the risk of data breaches. Imagine giving a valet a claim ticket instead of your car keys – that's tokenization in a nutshell.

Encryption, on the other hand, scrambles data into an unreadable format. This renders it useless to unauthorized individuals. Robust encryption protocols, such as AES-256, are essential for secure payment processing. These measures ensure that even if a breach occurs, the stolen data remains unusable. For a better user experience, consider optimizing your website's design: How to master UX/UI design.

Effective fraud detection systems are another vital component of secure payment integration. These systems must be tailored to UK payment patterns to avoid frustrating legitimate customers with false positives. Analyzing transaction data, IP addresses, and device fingerprints can help identify potentially fraudulent activities.

Generic fraud solutions often miss the nuances of UK payment behavior. This can lead to declined transactions for genuine customers, resulting in lost sales and damaged relationships. Hence, the need for tailored fraud prevention strategies cannot be overstated.

Complying with the General Data Protection Regulation (GDPR) is non-negotiable for UK businesses handling customer payment data. This involves implementing strict data privacy policies, being transparent about data collection and usage, and giving customers control over their information.

Businesses also need explicit consent for data collection and must ensure secure storage of sensitive information. GDPR compliance isn't simply about ticking legal boxes; it demonstrates to customers that you value their privacy and take data protection seriously. This builds trust and strengthens customer relationships.

The right security measures can actually boost your conversion rates. When customers feel confident about payment security, they are more likely to complete their purchase. Conversely, security concerns can lead to cart abandonment, impacting your profits.

Investing in robust security not only protects your business but also drives sales. By implementing these security measures, UK businesses can build trust, protect customers, and achieve greater success in the competitive online market. This creates a win-win: increased customer loyalty and sustainable business growth.

The difference between a decent and a truly great mobile payment experience can be huge, and it’s often where UK businesses lose potential customers. It's not just about offering mobile payments; it's about designing an experience that encourages sales. Let's explore the design elements and checkout processes that can help reduce abandoned carts, specifically for UK consumers.

UK consumers rely heavily on mobile devices for shopping. To tap into this market, your mobile payment experience needs to be smooth and secure. Consider how easy it is to tap buttons on a smaller screen, how quickly pages load on mobile networks, and how simple it is for customers to enter their information. A clunky interface and slow loading times will quickly drive customers away.

Streamlined Checkout Flow: Simplify your checkout process. Fewer steps mean less chance of someone abandoning their cart. Guest checkout options can also remove the barrier of account creation.

Mobile-First Design: Prioritize a mobile-first approach. Design for smaller screens and touch interactions from the very beginning, not as an afterthought.

This mobile-focused strategy is essential for maximizing conversions in the UK's increasingly mobile-driven e-commerce market.

Security is crucial, but it shouldn’t sacrifice convenience. Biometric authentication, like fingerprint scanning and facial recognition, offers an ideal balance. It increases security without adding extra steps to the checkout, directly addressing a key concern for UK online shoppers.

Many leading retailers are using biometric authentication, significantly boosting their mobile conversion rates. Seamless security removes a potential obstacle to purchase, improving the user experience and directly increasing sales.

Integrating common UK mobile wallets like Apple Pay and Google Pay is a must. But just offering these isn’t enough; integration needs to be strategic and frictionless.

One-Click Payments: Enable one-click payments using stored wallet information. This removes the need to repeatedly enter card details, saving time and effort.

Prioritize Wallet Placement: Display mobile wallet options prominently during checkout to encourage their use and highlight the convenience they provide.

Optimizing wallet integration minimizes transaction friction and enhances the overall checkout process, ultimately leading to higher conversion rates for your UK customers.

Real-world examples show how targeted improvements impact mobile payment performance. Examining successful UK businesses reveals valuable insights. Look at companies that have boosted their conversion rates through these strategies.

By understanding what works in the UK market, you can apply these lessons to your own business. Creating mobile payment experiences tailored to how UK customers shop provides a competitive edge. This targeted approach is much more effective than generic mobile advice and greatly improves your chances of success.

To further illustrate this point, let's examine the current landscape of UK payment methods:

This table provides data on the most popular payment methods in the UK and how complex they are to integrate into an e-commerce platform.

| Payment Method | UK Consumer Adoption Rate | Integration Complexity | Processing Time | Transaction Fees | Best For Business Type |

|---|---|---|---|---|---|

| Debit Cards | High (Over 80%) | Low | Real-time | Low (typically <1%) | All |

| Credit Cards | High (Over 70%) | Low | Real-time | Moderate (1-3%) | All |

| Apple Pay | Medium (Growing rapidly) | Medium | Real-time | Similar to card fees | Online and mobile-first businesses |

| Google Pay | Medium (Growing steadily) | Medium | Real-time | Similar to card fees | Online and mobile-first businesses |

| PayPal | High (Over 60%) | Low | Real-time | Moderate (varies based on transaction volume) | All, especially international businesses |

| Bank Transfers (Faster Payments) | Medium (Increasing) | Medium | Real-time | Low (typically fixed fee or free) | B2B and larger transactions |

As you can see, offering a range of payment options, especially those favored by UK consumers, and optimizing their integration can greatly influence your conversion rates. Focus on minimizing complexity and processing times while keeping fees competitive to maximize customer satisfaction and drive sales.

Integrating a payment gateway is a big step for any UK business. However, the real work begins after the initial setup. Maintaining smooth and reliable payment processing requires proactive troubleshooting and robust monitoring. This helps ensure your customers have a seamless experience.

Even with the best preparation, problems can still occur. 3D Secure authentication failures, for instance, are a common issue for UK cardholders. These failures can silently drive customers away without you even realizing it. Understanding the reasons behind these failures is crucial. Incorrect card details, expired authentication windows, or problems with the customer's bank can all contribute to 3D Secure issues.

Additionally, address verification failures can lead to declined transactions. Making sure your address verification system is correctly configured and compatible with UK addressing formats is key to preventing customer frustration.

Thorough testing is vital for catching potential problems before they affect your customers. Develop a comprehensive testing strategy that covers every step of the payment process. This includes simulating various scenarios, such as:

Varying transaction amounts

Edge cases like refund processing and failed transactions

Paying close attention to UK-specific payment habits, like the preference for debit cards, is essential for effective testing.

Proactive monitoring is your first line of defense against payment issues. A robust monitoring system keeps track of important metrics like transaction success rates, processing times, and decline rates. This lets you identify potential problems early, before they become major headaches. Visual dashboards and automated alerts can notify you of any unusual activity, allowing for a swift response.

Equally important are clearly defined resolution workflows. Having a set process for dealing with declined transactions, including customer communication templates and escalation procedures, minimizes disruption and helps maintain a positive customer experience.

The world of payments is always changing. Regulatory updates, such as changes to Strong Customer Authentication (SCA) or the rise of Open Banking, can significantly affect your payment integration. Staying informed about these changes and adapting your systems is critical for continued success.

Customer expectations are also constantly evolving. Keeping up with new payment technologies and consumer preferences will help you stay competitive in the UK market. By addressing potential payment challenges proactively, UK businesses can provide a smooth and secure payment experience, building customer trust and driving growth.

The most successful UK businesses understand that integrating a payment gateway is more than just processing transactions; it's about unlocking a treasure trove of valuable data. By understanding how these top performers use this data, you can gain powerful insights to drive your own business decisions. This means looking beyond simple approval rates and delving deeper into the wealth of information available. You might also be interested in: How to master web development process.

While your payment approval rate is important, it's just the beginning. Consider setting up KPIs that truly reflect your payment performance.

Average Transaction Value: Understanding how much customers spend per transaction can inform pricing strategies and identify upselling opportunities.

Payment Method Preferences: Knowing which payment methods your customers prefer allows you to optimize the checkout experience.

Cart Abandonment Rates: A high cart abandonment rate signals potential issues with your checkout process.

Tracking refund rates and chargeback rates is also essential. These metrics can reveal underlying problems with your products, services, or checkout process. By addressing these issues, you can boost customer satisfaction and reduce costs.

Understanding how your customers prefer to pay is crucial for optimizing conversions. Are they using debit cards, credit cards, or mobile wallets like Apple Pay and Google Pay? Is there a preference for Buy Now, Pay Later services like Klarna?

Prioritize the most popular payment methods in the UK within your checkout process. For example, if many customers use mobile wallets, ensure these options are prominent during checkout. Offering popular Buy Now, Pay Later options can also attract new customers and increase average order values.

Leading UK businesses constantly refine their payment processes based on data. They create a feedback loop, using insights to improve conversion rates and customer experience. This involves A/B testing different checkout flows, experimenting with payment method placement, and analysing abandonment patterns.

For instance, a high abandonment rate at a specific checkout stage warrants investigation. The cause could be a technical glitch, a confusing form field, or unclear shipping costs. Continuous analysis and adaptation are key to creating a payment system optimized for the UK market.

Payment data can inform smarter decisions across your entire business. Analyzing payment flows can uncover growth opportunities, optimize pricing, and enhance customer experiences.

For example, data on payment method preferences can inform marketing campaigns. If a particular demographic favors a specific payment method, tailor advertising accordingly. Payment data can also identify your most valuable customers. By understanding their spending habits, you can personalize their experience and build stronger relationships.

This strategic use of payment data creates competitive advantages beyond the checkout. It allows you to build a more customer-centric business and drive long-term growth.

Ready to build a high-performing web application tailored to your business needs? Explore our Laravel web development services at Iconcept ltd.